Sadly, most auto insurance policyholders have stayed with the same insurance company for at least the last four years, and about 40% of consumers have never compared rates to find cheaper insurance. With the average auto insurance premium being $1,387, California drivers could save themselves roughly 35% a year just by comparing rates, but they just assume it’s a time-consuming process to find cheaper insurance by shopping around.

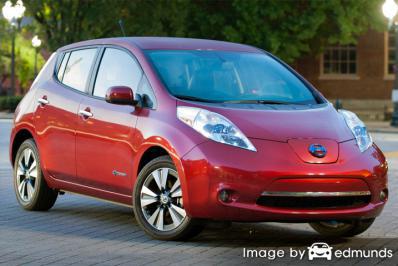

Really, the only way to get more affordable Nissan Leaf insurance in Stockton is to regularly compare prices from companies in California.

Really, the only way to get more affordable Nissan Leaf insurance in Stockton is to regularly compare prices from companies in California.

Step 1: It will benefit you to learn about how companies set rates and the steps you can take to keep rates down. Many factors that cause rate increases such as traffic violations and a negative credit history can be rectified by making small lifestyle or driving habit changes. Continue reading for the details to get low prices and get additional discounts.

Step 2: Obtain price quotes from direct, independent, and exclusive agents. Direct and exclusive agents can only give prices from a single company like GEICO and Allstate, while independent agents can quote prices from multiple insurance companies.

Step 3: Compare the new rates to the price on your current policy to see if a cheaper price is available. If you find a lower rate and switch companies, ensure there is no coverage lapse between policies.

Step 4: Provide notification to your current agent or company to cancel your existing policy and submit any necessary down payment along with the completed application for your new policy. Once received, safely store the certificate verifying proof of insurance along with the vehicle’s registration papers.

One bit of advice is to use identical deductibles and limits on each quote and and to get price estimates from as many car insurance companies as possible. This helps ensure an accurate price comparison and a complete selection of prices.

The following companies have been selected to offer comparison quotes in California. If more than one company is shown, it’s a good idea that you click on several of them to get a more complete price comparison.

Don’t overlook these Nissan Leaf insurance discounts

Not many people think insurance is cheap, but there could be significant discounts that can help lower your rates. A few discounts will be applied when you get a quote, but a few must be manually applied prior to getting the savings.

- Life Insurance Discount – Not every insurance company offers life insurance, but if they do you may earn lower auto insurance rates if you buy auto and life insurance together.

- Fewer Miles Equal More Savings – Low mileage vehicles could be rewarded with better premium rates on cars that stay parked.

- No Claim Discounts – Insureds with no claims or accidents have much lower rates as opposed to drivers with a long claim history.

- Payment Method – If you pay your bill all at once rather than spreading payments over time you can avoid the installment charge.

- Seat Belts Save more than Lives – Using a seat belt and requiring all passengers to fasten their seat belts can save up to 10 percent (depending on the company) off the personal injury premium cost.

- Paperwork-free – A few larger online companies provide a small discount simply for signing on your computer.

- College Student – College-age children living away from Stockton attending college and do not have access to a covered vehicle may qualify for this discount.

- Stockton Homeowners Discount – Owning a house in Stockton can save you money since home ownership requires a higher level of personal finance.

- Federal Employees – Active or retired federal employment can save as much as 8% depending on your company.

- Sign Early and Save – Some larger companies provide a discount for switching to them prior to your current Leaf insurance policy expiration. This discount can save up to 10%.

Keep in mind that most discounts do not apply to the overall cost of the policy. Most only apply to the price of certain insurance coverages like physical damage coverage or medical payments. So even though they make it sound like having all the discounts means you get insurance for free, it just doesn’t work that way.

To locate providers who offer auto insurance discounts in California, follow this link.

Lower Your Stockton Insurance Premiums

A large part of saving on car insurance is knowing some of the elements that play a part in calculating your policy premiums. If you have a feel for what determines base rates, this allows you to make good choices that can earn you much lower annual insurance costs. Lots of factors are taken into consideration when you get a price on insurance. Most are fairly basic like a motor vehicle report, but other factors are less apparent such as your credit history or how financially stable you are.

The following are a partial list of the pieces used by companies to determine rates.

- Don’t skimp on liability insurance – Liability coverage will provide protection if ever a court rules you are at fault for causing personal injury or damage in an accident. It will provide legal defense coverage which can be incredibly expensive. Carrying liability coverage is mandatory and cheap compared to comp and collision, so drivers should buy more than the minimum limits required by law.

- Which gender costs less? – Statistics have proven that females take fewer risks when driving. This data doesn’t prove that men are WORSE drivers than women. Men and women get in at-fault accidents in similar numbers, but the male of the species cause more damage. In addition to higher claims, males also get more serious tickets such as DWI and reckless driving.

- Be proud to be claim-free – Companies in California give better rates to people who are not frequent claim filers. If you are the type of insured that files lots of claims you can pretty much guarantee higher premiums or even policy non-renewal. Insurance coverage is designed for larger claims.

- Cautious drivers have lower prices – Having just one chargeable violation could increase your next policy renewal to the point where it’s not affordable. Drivers who don’t get tickets receive lower rates than people who have multiple driving citations. Drivers unfortunate enough to have careless tickets such as reckless driving or DUI are required to submit a SR-22 form with their state DMV in order to drive a vehicle legally.

-

Nissan Leaf historical loss data – Insurance companies include the past claim history for a vehicle when they calculate premium costs for each model. Vehicles that the statistics show to have higher number or severity of losses will be charged more to insure. The table below outlines the historical loss data for Nissan Leaf vehicles.

For each insurance policy coverage type, the loss probability for all vehicles, as a total average, is represented as 100. Values under 100 indicate a favorable loss history, while percentages above 100 point to more frequent losses or an increased probability of a larger loss.

Insurance Loss Ratings for Nissan Leaf Vehicles Vehicle Make and Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury Nissan Leaf Electric 89 84 45 83 64 76 BETTERAVERAGEWORSEData Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Are insurance agencies of importance?

A small number of people prefer to get advice from a local agent and doing so can bring peace of mind Licensed agents are highly skilled in risk management and help in the event of a claim. The best thing about comparing auto insurance online is the fact that drivers can get lower rates and also buy local. And buying from local agencies is still important in Stockton.

Once you complete this short form, the coverage information is transmitted to agents in your area that provide free Stockton car insurance quotes for your insurance coverage. It’s much easier because you don’t need to find an agent because prices are sent directly to you. If you have a need to get a price quote from one company in particular, you can always find their quoting web page and complete a quote there.

When finding a local insurance agency, it can be helpful to understand the different agency structures that differ in how they can insure your vehicles. Auto insurance policy providers are classified as either exclusive agents or independent agents. Either one can provide auto insurance policies, but it’s a good idea to understand how they differ since it can impact the type of agent you choose.

Independent Auto Insurance Agencies or Brokers

Independent insurance agents are normally appointed by many insurers and that allows them to write policies with a variety of different insurance companies and find you the best rates. To move your coverage to a new company, they can switch companies in-house and the insured can keep the same agent.

If you are comparing rate quotes, it’s recommended you compare prices from several independent agencies to get the most accurate price comparison.

The following is a small list of independent agencies in Stockton who may provide free auto insurance quotes.

Rangel Insurance

6025 Pacific Ave – Stockton, CA 95207 – (209) 474-7777 – View Map

Protection Providers Insurance Agency

304 W Harding Way – Stockton, CA 95204 – (209) 466-1072 – View Map

Mark Berbower Insurance Agency

2 W Swain Rd – Stockton, CA 95207 – (209) 405-1088 – View Map

Exclusive Auto Insurance Agents

Agents of this type can only provide one company’s prices and some examples include AAA, Allstate, and State Farm. Exclusive agents cannot compare other company’s rates so you might not find the best rates. They are usually well trained on sales techniques which helps them sell on service rather than price.

Shown below is a list of exclusive agents in Stockton willing to provide price quote information.

Farmers Insurance – Manuel Luna

445 W Weber Ave #225 – Stockton, CA 95203 – (209) 957-8675 – View Map

Ramon Fernandez – State Farm Insurance Agent

3443 Deer Park Dr D – Stockton, CA 95219 – (209) 461-0170 – View Map

Farmers Insurance: Edward Barney

1350 W Robinhood Dr #3 – Stockton, CA 95207 – (209) 477-6215 – View Map

Choosing an insurance agency is decision based upon more than just the quoted price. These are some questions you should get answers to.

- Do the agents have professional certifications like CPCU or CIC?

- Can they provide you with a list of referrals?

- Do they have 24-hour customer assistance?

- Are you getting all the discounts the company offers?

- Where would glass claims be handled in Stockton?

- Which companies can they place coverage with?

One last note

Low-cost Nissan Leaf insurance in Stockton can be found online and from local insurance agents, so you need to quote Stockton car insurance with both in order to have the best chance of saving money. There are still a few companies who may not have internet price quotes and most of the time these regional insurance providers only sell through independent agents.

In this article, we covered quite a bit of information on how to lower your Nissan Leaf insurance auto insurance rates in Stockton. The most important thing to understand is the more you quote Stockton car insurance, the better chance you’ll have of finding low cost Stockton car insurance quotes. You may even be surprised to find that the most savings is with some of the smallest insurance companies. Regional companies may only write in your state and offer lower premium rates than their larger competitors like Allstate, GEICO and Progressive.

Additional resources

- Distracted Driving Extends Beyond Texting (State Farm)

- Choosing an Insurance Company (Insurance Information Institute)

- Rearview cameras reduce backing crashes (Insurance Institute for Highway Safety)

- Air Bags: Potential Dangers to Your Children (Insurance Information Institute)